India’s next economic shift - can consumption drive growth?

A take from Blume Ventures Indus Valley Report 2025.

If you missed the last post, I explored how AI is reshaping India’s services-led growth. Read it here for context:

Now, let's look at what comes next.

For decades, India’s economic rise has been powered by services and exports.

But with AI disrupting outsourcing and manufacturing yet to become a major driver, the question is - can India transition into a consumption-led economy like the US?

Private consumption already makes up nearly 60% of GDP, but numbers don’t tell the whole story.

India’s per capita income is around $2,900, far behind China’s $13,900 and nowhere close to the US at $89,000.

A strong consumption-driven economy needs widespread purchasing power, and that’s where the challenge is for India.

With incomes this low, spending patterns look vastly different across the population.

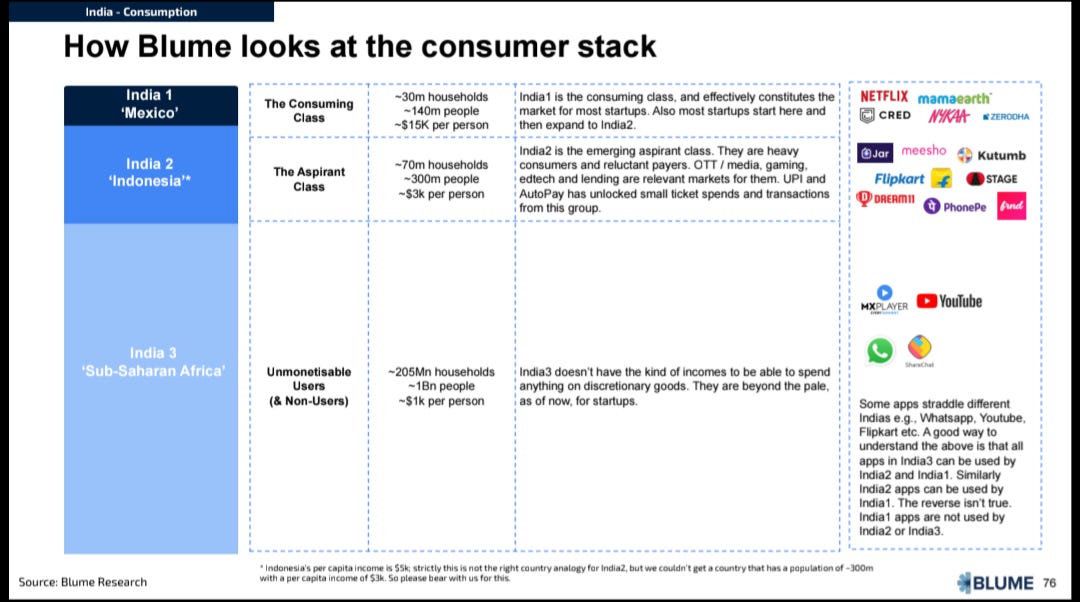

The top of the pyramid, India1, around 140 million people, drives premium spending on brands like Netflix, Cred, and Nykaa, making them the consuming class.

The aspirant class, India2, nearly 300 million, are reluctant payers, and uses apps like Flipkart, PhonePe, and Dream11.

But the majority, India3, over a billion people, operates in an economy where for most, spending beyond essentials isn't an option.

Platforms like WhatsApp and YouTube see massive engagement from India3, but they don’t translate into the kind of economic activity that drives sustained growth.

A growing middle class and rising digital adoption might hint at change, but inflation, slow wage growth, and unemployment still holds back spending.

Unlike the US, where wages, credit, and social security sustain consumption, India still lacks the foundation for large-scale domestic demand.

While India has a large demand market, there aren't enough people who can afford to drive it.

And that gap between demand and purchasing power is only getting wider. More on that next.